E-book Value Vs Market Value In Finance Understanding The Key Differences

This signifies that the worth of an asset in accounting information is recorded at its authentic acquisition price, not what it might be worth right now. For instance, when you bought a piece of equipment for $10,000 five years in the past and its current market value has risen to $15,000, the book value will still mirror the initial purchase worth of $10,000. This principle ensures transparency and consistency in financial reporting through the use of verifiable information from the past. Book worth (also generally recognized as carrying value or net asset value) is an asset’s worth as recorded on a company’s balance sheet.

Why Do These Metrics Matter For Investors?

Shifts in rates of interest, economic cycles, and business actions influence market value, often creating discrepancies from book value. Combining quantitative ratios with qualitative evaluation supplies a complete strategy to distinguishing between book and market value for knowledgeable investing. Corporations often report their whole belongings and liabilities on their steadiness sheets, which could be found of their quarterly and annual reviews. For occasion, Microsoft reported whole belongings of around $301 billion and complete liabilities of about $183 billion. When we talk about liquidity impression, it’s like considering how simply you possibly can flip a chunk of paper into money.

Book value serves as a basic device for assessing a company’s financial health. It supplies a clear image of the company’s tangible assets minus liabilities, revealing the firm’s intrinsic financial power. Market value, nevertheless, provides a view of the company’s potential growth and future earnings, reflecting how confident buyers are about its prospects. By evaluating these values, you can assess not solely the company’s present monetary status but additionally its market status and potential for future success.

Overestimating Market Value

It encompasses frequent inventory, preferred stock, retained earnings, and extra paid-in capital, reflecting shareholders’ possession stake. Companies report shareholder equity on the steadiness sheet, providing perception into monetary health and the value attributable to shareholders. Analysts use shareholder equity to calculate key financial ratios similar to return on fairness (ROE), indicating profitability relative to equity. When contemplating investments, it’s important to understand how book and market values can affect each long-term and short-term strategies. For long-term investments, focus on guide value, as it provides a secure indicator of a company’s underlying worth and asset power. Book worth provides you a better sense of an organization’s well being, whereas market worth reflects investor sentiment and future development potential.

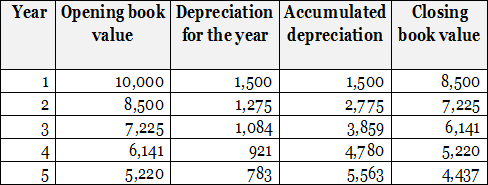

It reveals how much you would obtain if you were to liquidate your property in the current market. E-book value is the quantity you paid for an asset minus depreciation, or an asset’s decreased worth as a outcome of time. Additionally often recognized as net guide value or carrying worth, guide value is used on your business’s steadiness https://www.simple-accounting.org/ sheet underneath the fairness part. When you assume about shopping for a home, you often seek the guidance of with real property appraisers to know the fair market worth of the property. This course of is akin to figuring out how a lot someone would be keen to pay in your house at any given time based on various elements. However, the dedication of the market value of illiquid assets is a difficult course of.

E-book worth is especially relevant for assessing a company’s financial stability and figuring out if a inventory is undervalued or overvalued. Market value, however, is more related for short-term investors and merchants who are interested in buying or promoting belongings based on present market circumstances. Guide value is especially helpful in industries where property play a big position, such as manufacturing or actual property.

It reflects the accounting perspective, emphasizing the historic costs and book-oriented evaluation. When it involves evaluating the monetary well being and development potential of a company’s inventory, understanding the excellence between e-book value and market worth is essential. Each these values offer distinctive insights into a company’s monetary standing and might help investors make knowledgeable decisions. In this article, we are going to delve into the differences between e-book value and market worth and discover how they are utilized by buyers to identify promising funding opportunities.

Sources like Investopedia and firm web sites can present priceless information and tools for analyzing these ideas in depth. Market value, nonetheless, is influenced by market tendencies, investor sentiment, financial situations, and company performance expectations. Exterior factors such as business information, market speculation, and competitor exercise also play a significant position in shaping market worth.

- Overall, differentiating between e-book and market value permits traders to undertake a disciplined, knowledgeable strategy, in the end fostering extra successful value investing outcomes.

- The distinction lies virtually entirely in belongings you can’t simply placed on a stability sheet.

- Buyers can calculate e-book value per share by dividing the company’s book value by its number of shares outstanding.

- Ultimately, integrating accurate value assessments into investment methods enables investors to capitalize on market inefficiencies responsibly.

It is calculated by subtracting the accrued depreciation or liabilities from the entire belongings or equity. On the other hand, market worth represents the current value of an asset or an organization within the open market, based on the forces of provide and demand. It is determined by the perceived worth of the asset or the corporate by buyers and may fluctuate considerably over time. Guide value and market value are two basic concepts in business valuation that provide insights right into a company’s financial well being and profitability. Book worth represents the online asset worth of an organization as recorded on its ledger and monetary statements, calculated by subtracting liabilities from assets.

Buyers should therefore contemplate whether market optimism or pessimism influences discrepancies. Employing valuation ratios such as the price-to-book (P/B) ratio helps quantify these differences objectively. Basic evaluation strategies, together with examining monetary statements and economic trends, further aid in determining whether discrepancies are justified or indicative of market inefficiencies. This complete method strengthens the decision-making course of in value investing.